Dedollarization

An overview

Three primary sources provide the impetus for widespread and intensifying international dedollarization: America’s widespread use of sanctions (and freezing of USD reserves and USD-denominated assets); the colossal size of America’s federal debt (which will never be repaid); and opacity relating to the monetary supply of the United States.

Symptoms of this dedollarization include a reduction in Chinese holdings of treasury bills; significant new buying of gold as a reserve asset by central banks; the rise of the petroyuan; the creation of alternatives to the Belgium-based, western-led SWIFT interbank communication platform; a world on the cusp of the introduction of several new trade and reserve currencies, the proliferation of bilateral currency swap arrangements; and the creation of new sources of finance independent of the World Bank and International Monetary Fund.

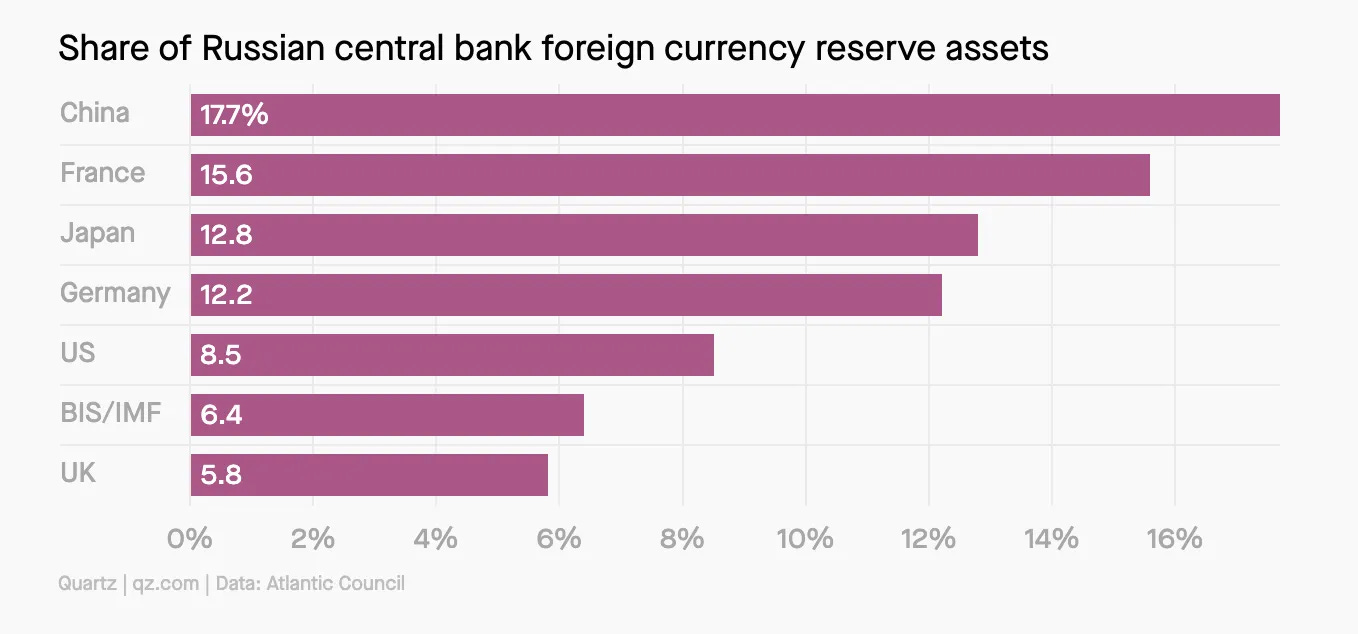

Shortly after Russia initiated its special military operation in Ukraine, the US, UK, Europe and Canada kicked Russia off of SWIFT, with carve out for energy payments. On February 27, 2022 the European Union introduced a suite of sanctions directed at Russia, including freezing its gold and foreign reserves. The next day “the US, Japan, the UK , and traditionally neutral Switzerland,” joined in the sanctions. This resulted in Russia having about $300 billion of its $640 billion in foreign reserves stolen. In this, Russia joins a long list of countries who have had their foreign reserves hijacked when they have displeased the United States and its vassal states.

The US deficit is absolutely staggering. The official figure is $31 trillion but if “$55.12 trillion in unfunded Medicare benefits and $41.20 trillion in unfunded Social Security benefits” are counted the figure is closer to $126 trillion. Some even estimate it to be $222 trillion. Compare this to an annual gross world product of $80 trillion (2017). The Treasury Department issues Treasury bills and then the Federal Reserve issues money, lately shot straight to Blackstone and the other big hedge funds and the big banks. This is a giant Ponzi scheme. Such legerdemain alone ensures that the federal debt will never be repaid, to say nothing of how much it would theoretically commit each working American taxpayer for “their share” of the debt (they never agreed to).

The American money supply is extremely opaque as well. In early 2021, the Federal Reserve “discontinued updating the M1 and M2 weekly money supply series.” The Fed also quit “reporting the M3 money supply measure in March of 2006.” The Federal Reserve eliminated any banking reserve requirements on March 15, 2020, which means there is no limitation on their lending portfolio.

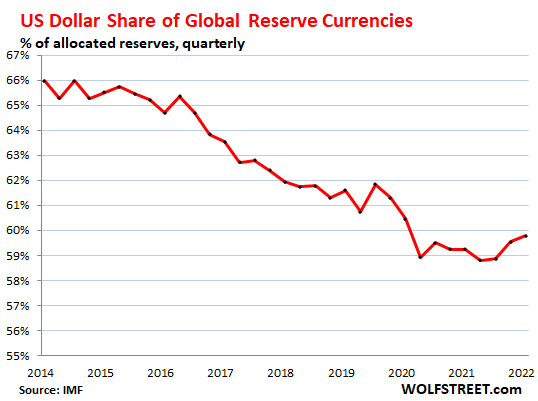

Sanctions, the federal debt, and a murky American money supply have severely undermined destroyed trust in American and allied financial institutions as safe havens. As a result, the USD share of global reserve currencies has been slowly but steadily declining.

In 2009 then Treasury secretary Timothy Geithner was asked by a group of Chinese graduate students if China's massive treasury bill holdings were safe. They laughed him out of the room when he said they were. China’s overall foreign exchange reserves were “$3.18 trillion in January 2023.” China's holdings of “U.S. government debt dropped to $967.8 billion in June 2022, the lowest since May 2010 when it held $843.7 billion.” However, China remains highly exposed to dollar-denominated assets. China's ownership of less liquid but higher yielding bonds from U.S. government-sponsored agencies (like mortgage provider Freddie Mac) rose by $50.9 billion. China may also be utilizing “third-party custody countries like Belgium, whose holdings of Treasuries have trebled in the last five years to more than $300 billion.”

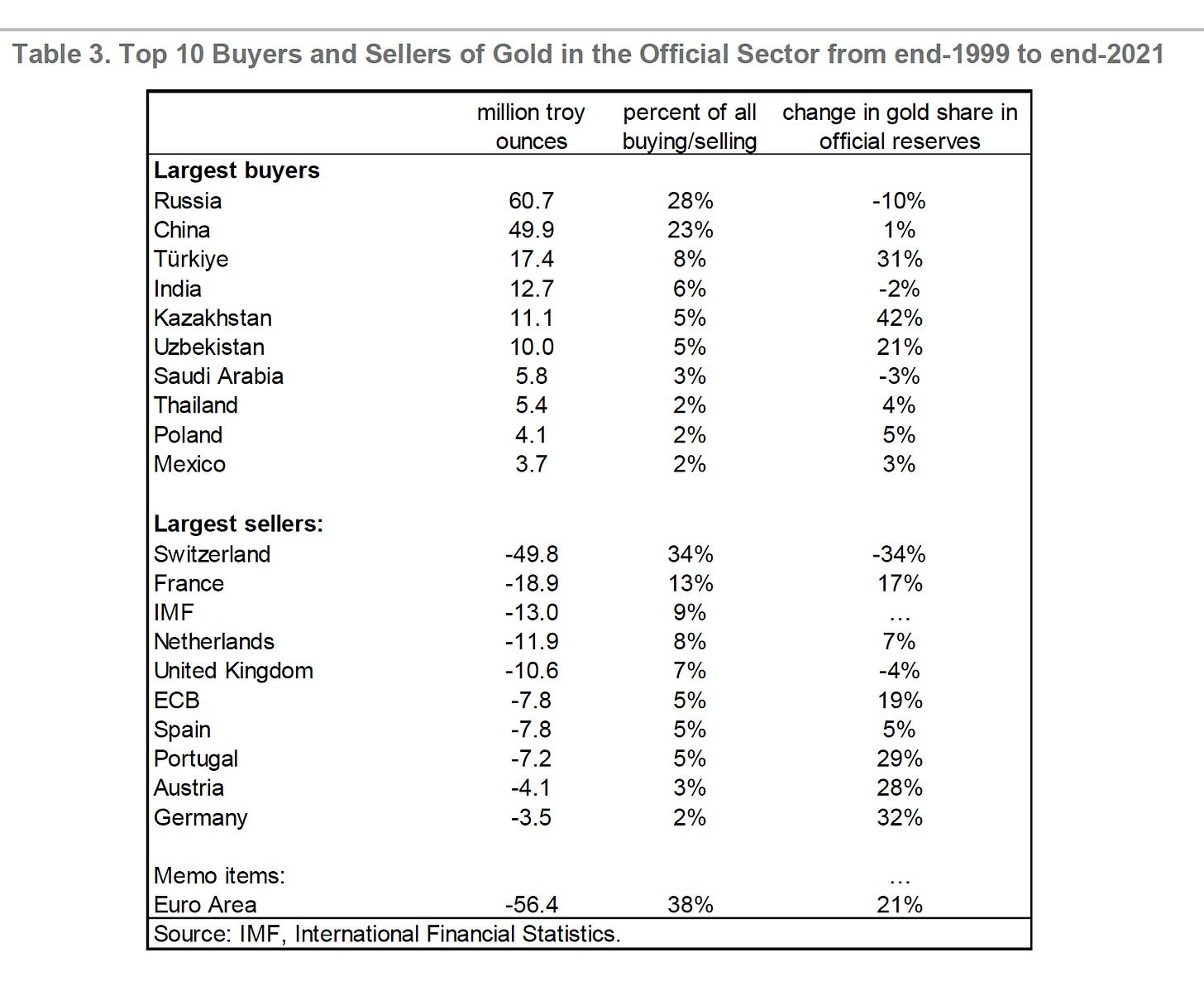

The finance capitalists led by Wall Street have put a lot of effort for decades into disparaging gold as a “barbarous relic” because it doesn’t generate interest (and can’t be packaged and sold by Wall Street to gullible retail consumers or even theoretically sophisticated institutional investors). Nevertheless, no less a lynchpin of western finance capitalism than the IMF issued a report in January 2023 with the particularly telling title of “Gold as International Reserves: A Barbarous Relic No More?”

In fact, the report explicitly stated that one of the primary motivations for countries buying more gold as a reserve were the endless sanctions levied by the United States and its vassals. It also mentioned its traditional role as a store of value in times of geopolitical risk and economic uncertainty. Certainly, there can be no more troubled geopolitical time than when a unipolar hyperpower is collapsing – especially when its political and financial elites are too hide-bound by their myopic consensus reality to even recognize it is collapsing.

Central banks bought 1,136 tons of gold ($70 billion) in 2022, “by far the most of any year since 1967.” This was right before Nixon took the USD off of the gold standard in 1971 and may presage a moment as equally epoch-making as that, which marked the end of the post-World War II Breton Woods financial system (and the beginning of the petrodollar era, which is also ending).

These are doubtless among the key reasons the World Gold Council “says central bank gold demand hit an all-time high in 2022,” the “the second consecutive year-on-year increase in demand” from that sector. Demand surged as the year progressed. Of the 1,136 tons purchased last year, 417 tons were purchased in the final quarter and 800 tons “were purchased in the second half of the year.” While BRICS applicant Turkey led 2023 buying with 148 tons, BRICS and Shanghai Cooperation Organization members were leading buyers as well. China purchased 30 tons in November 2022, 32 tons in December 2022, and 15 tons in January 2023, to bring their reserves to a total of 2,025 tons. Although Russia no longer issues “monthly data on its purchases, but it is widely believed to be active in the market.” India’s 33 ton and Uzbekistan’s 34 ton purchases were substantial as well. Smaller Shanghai Cooperation Organization members Kyrgyzstan and Tajikistan bought six and four tons respectively last year.

In the chart below, taken from the IMF’s January 2023 gold report, Shanghai Cooperation Organization members Russia, China, India, Kazakhstan, and Uzbekistan have long term buyers as well. So have BRIC applicants Turkiye and Saudi Arabia been too. Pioneering partner to the China-led mBridge central bank digital currency trade settlement mechanism, Thailand, was also.

These purchases make sovereign currencies more attractive for international trade settlements. They have already led to a gold-backed petroyuan and may lead to further new gold-backed currencies in the near- to medium-term future.

Even Germany was nervous enough about the storage of their gold with ostensible allies that they finished repatriating 743 tons of gold from New York and Pairs in 2017.

Among the most ominous signs of dedollarization from the point of view of the Beltway Bubble and Wall Street is the rise of the petroyuan.

In 1974, three years after Nixon closed the gold window, Henry Kissinger went to Saudi Arabia and negotiated an agreement with the kingdom to provide them with military protection in exchange for them pricing oil in dollars. Since then 80% of oil sales have been sold for dollars. Of America’s many pointless wars kicking off the 21st century, the longest was Afghanistan. The Washington Post’s 2019 Afghanistan Papers (which had virtually no impact on American society) provided extensive documentation that political and military leaders from the top down from the very beginning saw no strategic purpose in the war or exit strategy from it. The 2021 debacle, while welcome and belated, was a debacle. In the midst of the chaotic withdrawal, Saudi Arabia and Russia signed a little-noticed agreement to foster joint military cooperation.

In 2018, China introduced “yuan-denominated oil contracts” for the purchase of overseas crude. Nigeria was an early adopter. China buys 25% of Saudi Arabia’s oil exports. In January 2023 at the Davos World Economic Forum, the Saudi finance minister Mohammed Al-Jadaan announced to openness of the kingdom to selling its exports for yuan.

New payment systems and interbank communication systems that bypass SWIFT are proliferating as well. Among the corporations that sanctioned Russia after they began their special military operation in Ukraine were Visa and Master Card. Within days Russia’s MIR payment card was linked with China’s Union Pay payment card with minimal disruption and almost instantaneously dedollarized the Russian economy.

Russia’s System for Transfer of Financial Messages has linked with China's Cross-Border Interbank Payment System. Russia’s financial messaging system has also linked with “Iran’s SEPAM national financial messaging service” and is offering the proposal to India as well.

A number of new currencies are in trial or vision casting phases. The most important trial currency (which is also a settlement rail alternative to SWIFT) is the Chinese central bank digital currency, the digital yuan, through the mBridge facility now in phase for Belt and Road Initiative financing. mBridge is a blockchain collaboration between the “Bank of International Settlements Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People's Bank of China and the Central Bank of the United Arab Emirates.” Besides banks from China, Hong Kong, and the United Arab Emirates, participants also included international banks like “HSBC and Standard Chartered which previously participated in the Thai-Hong Kong cross border CBDC trials, as well as Goldman Sachs, Societe Generale, UBS and Singapore’s DBS.” A five week trial during August - September 2022 issued $12 million in currency and settled $22 million in cross-border trade. Another important multi-central banks digital currencies experiment is Project Dunbar, involving the “Bank of International Settlements, and the central banks of Singapore, Malaysia, South Africa and Australia.”

Sergey Glazyev, minister in charge of integration and macroeconomics of the Eurasia Economic Council, has discussed creating a new trading currency based on a basket of participating sovereign currencies and “around 20 exchange-traded commodities.”

The BRICS are poised to expand this year, likely adding Saudi Arabia, Iran, and Argentina as members at their next meeting. “The United Arab Emirates, Algeria, Egypt, Bahrain and Indonesia, along with two nations from East Africa and one from West Africa” stand at the door applications in hand.

On June 22, 2022, Putin announced that the “BRICS are working on new global reserve currency and alternative mechanism for international payments.” Each country in the BRICS has a different attitude towards this potential development.

The new BRICs currency might be called the R5, “based on the first letters of the BRICS currencies all of which begin with the letter R (real, ruble, rupee, renminbi, rand).” The Singapore dollar and the United Arab Emirate’s dirham are also being considered for inclusion.

The central banks of Russia and Iran are considering the establishment of a gold-backed central bank digital currency for foreign trade settlements, particularly along the International North-South Transport Corridor, “a landmark initiative for Eurasian connectivity,” that cuts traditional trade routes between Russia and India in half. What began as a collaboration between “India, Iran and Russia in 2000…has now expanded to include eleven more members, namely, Azerbaijan, Armenia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkey, Ukraine, Syria, Belarus, and Oman” (and Bulgaria has observer status).

Credit Suisse analyst Zoltan Pozsar has called the rise of commodity-backed Eastern currencies “Bretton Woods III.”

Lula campaigned last year on creating a South American trade currency, the Sur. The region accounts for 5% of gross world product, has been greatly increasing trade ties with China, has 58% of the world’s lithium in the Lithium Triangle (between Argentina, Bolivia, and Chile), and includes numerous Belt and Road Initiative signatories.

Bilateral currency swaps arrangements are proliferating as well. In October 2022, China expanded upon its Euro-Yuan swap mechanism. China also continues to expand its swaps with Japan, South Korea, and ASEAN countries, with the Russian ruble, Hong Kong Dollar, and Shanghai Cooperation Organization countries’ currencies. Between January 2009 and January 2020, the People’s Bank of China has established these types of mechanisms with 41 countries.

Russia has also been engaging in such bilateral currency swap mechanisms as well. As China is pushing for swap mechanisms with the Shanghai Cooperation Organizations, so too is Russia pushing for the same with the Eurasian Economic Union countries. They have already instituted such mechanisms with key trading partners like Iran and India.

Other key regional powers are arranging their own bilateral currency swaps. To cite just one important example “Turkey is trading in national currencies with China and Russia.”

Leaders of the emerging multipolar world are actively creating new sources of finance and “institutional statecraft” as alternatives to the World Bank and IMF. These include China’s Asian Infrastructure Investment Bank and the BRICS’ New Development Bank which added four new members at the beginning of 2022, “Bangladesh, Egypt, United Arab Emirates, and Uruguay.”

After Xi Jinping came to power in 2012 he gradually changed China’s economic policy to reduce its emphasis on lending money to America to enable them to be the buyer of last resort of their products. This has largely involved putting their massive currency reserves into the tangible assets of Belt and Road infrastructure; changing its focus from America to Eurasia, Africa, and Latin America; and moving quickly up the manufacturing value chain.

A number of factors prove that dedollarization is well underway. China may be making a political point by lessening their U.S. treasury bill holdings, or may simply be seeking the higher yields of government agency bonds. BRICS, Shanghai Cooperation Organization, and BRICS-applicant and NATO member Turkey have been leading a surge in central bank gold buying that goes back more than a decade and dramatically escalated over the last two years. Alternatives to SWIFT and the petrodollar are proliferating, most notably China’s Cross-Border Interbank Payment System, mBridge central bank digital currency mechanism, and rise of the petroyuan.

Numerous other new currencies may likely be introduced in the near future as well, most notably the BRICS R5. The BRICS and 152 Belt and Road Initiative countries represent 80% of the world’s population and 40% of the gross world product. The Belt and Road Initiative also includes all 13 OPEC member countries. Bilateral currency swap arrangements are being created around the world, by the great powers and regional powers and their many trading partners. Finally, new banks entirely outside of World Bank and IMF are being capitalized and lending prodigiously as well.

America’s gangster tactics of stealing the gold foreign reserves of any country that displeases its political and economic elites, an unfathomably massive deficit (that will never be repaid), and an occluded USD money supply have all contributed to dedollarization. Up to this point, the decline of the USD share of global reserves has been slow and steady. As the gold-backed petroyuan continues to prove itself and other new currencies are introduced, there may come a moment when there is a precipitous rush to the exit. Among those who might join the departure are the BRICS, the 152 Belt and Road Initiative countries, and the countries who either voted against or abstained from the March 2022 United Nations general assembly vote condemning the Russian invasion of Ukraine and demanding their withdrawal.

An important marker that dedollarization has arrived in earnest might be “20-20-20”: 20% inflation, $20/gallon gas, and 20% interest rates on treasury bills.